Instant Payments

Payments that Settle in Seconds

Offer consumers a fast, secure way to pay directly from their bank account. No card numbers, no delays, no chargebacks.

The Benefits are Instant Too

Positively influence cash flow by adding a payment system that works for you, not against you. Access funds in real-time and keep consumers coming back.

Your Loyalty Loop

Fast For Everyone

Every Payment Matters

Sell Local, at Scale

Expand across markets. Direct access to 3800+ European banks. No need for extra settlement accounts.

Four steps to payment success

Brite Performance

90%+

<30s

95%

Key feature

The technology behind Pay by Bank...but better

Routing payments across Europe within seconds, the Brite Instant Payments Network is built to process instantly 24/7, 365 days a year, minimising dependency on traditional bank clearing cycles and cut-off times.

Payment features that give you the edge

Pay faster next time

Automated Reconciliation

Instant Refunds

Our Customers

E-commerce

Financial Services

Financial services

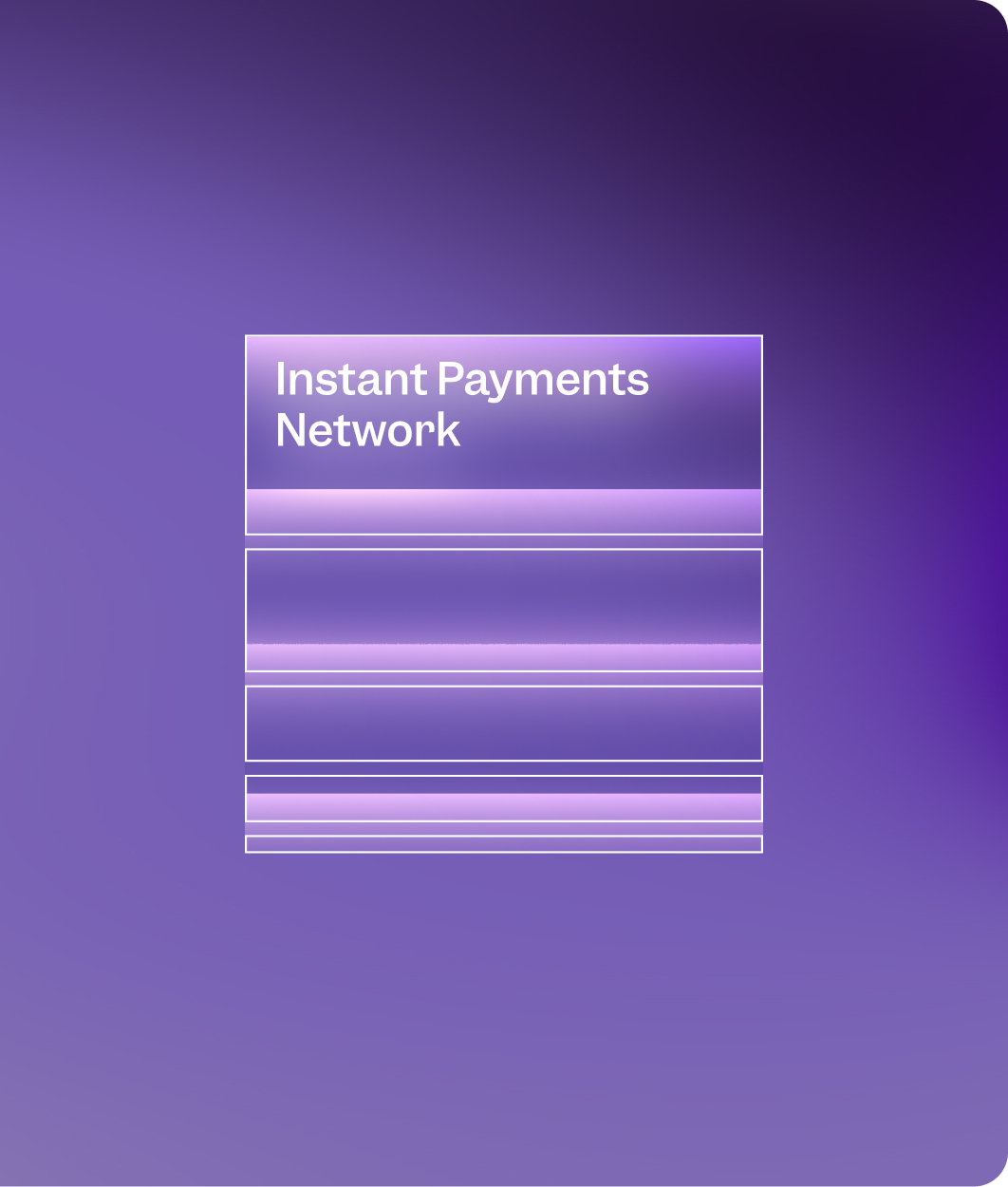

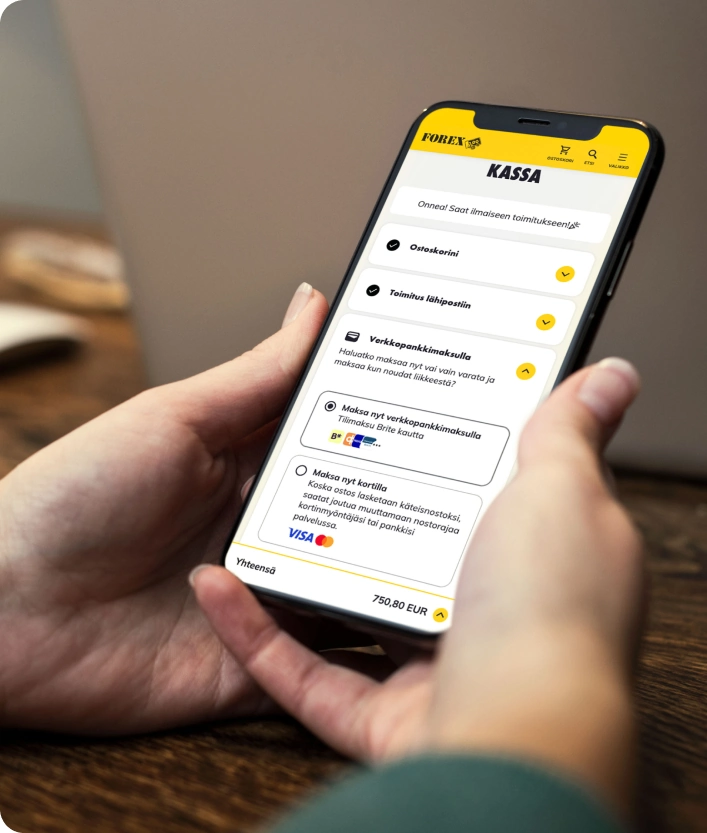

FOREX

Finally. An API you can rely on.

Integrate our payment solution with clean code and clear documentation. Built on a network with consistently high uptime, it’s the robust foundation your business needs.

Essential Resources

Your Instant Payments Questions Answered

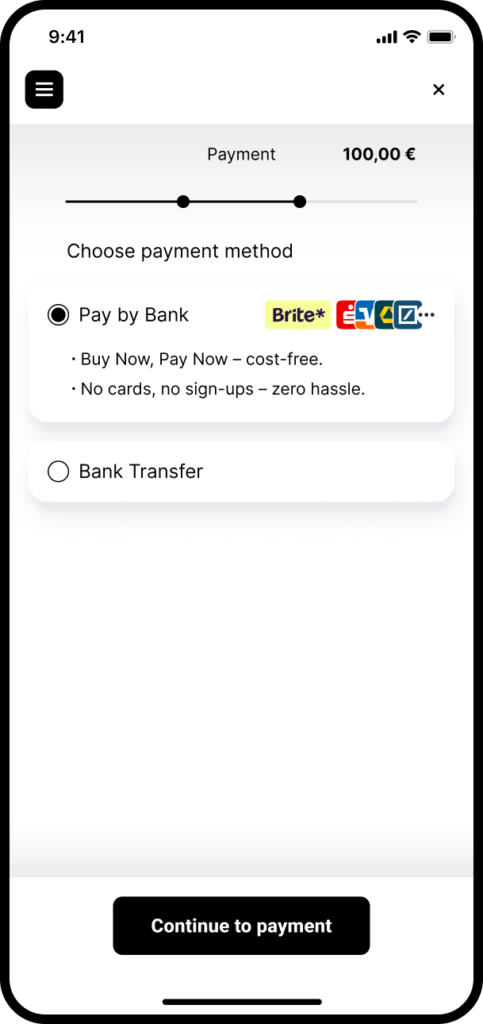

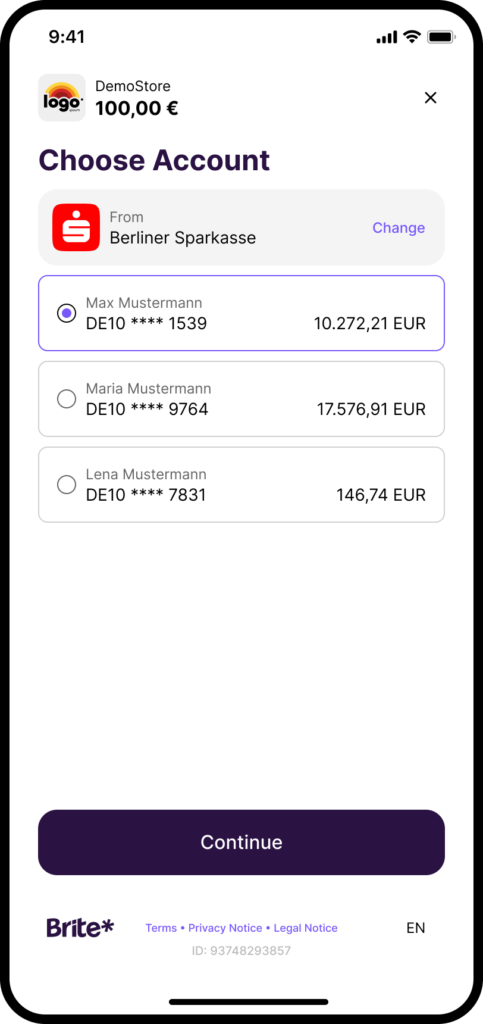

How do you pay with Brite Instant Payments?

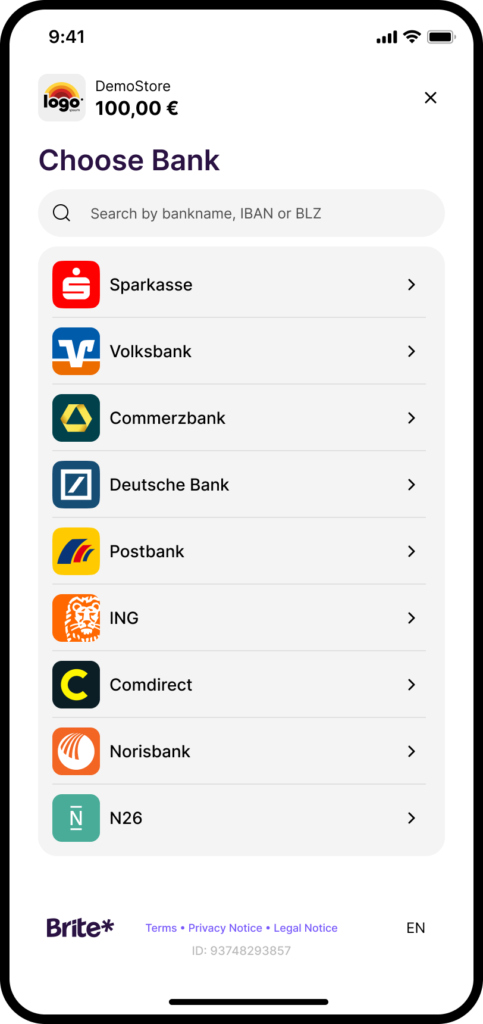

The process is fast and safe. The consumer simply chooses Brite at checkout, selects their bank from the list, and logs in securely using their bank’s usual identification method (such as biometrics or a digital ID). The payment is then authorised and processed instantly, without needing to input any card details or register an account.

Can a customer charge back a Brite Instant Payment?

No, chargebacks are virtually eliminated. Brite Instant Payments are direct Account-to-Account (A2A) transfers that the consumer authorises using their bank’s mandatory security protocols (SCA). Because the payment is authenticated and irrevocable, it removes your financial liability for card-related chargebacks.

How long does a Brite Instant Payment take? And how quickly does the money really settle in my balance?

Consumers typically spend less than 60 seconds from the start of the Brite payment experience to completion on a merchant’s website. Settlement typically happens in seconds, once authorised by the consumer.

Brite leverages its proprietary network (Brite IPN) to route payments in the most efficient way possible, minimising dependency on traditional bank clearing cycles. This provides you with real-time payment confirmation and improved cash flow.

How do Brite Instant Refunds work? And how do I issue a refund for a payment made with Brite?

Refunds are processed just as quickly as the original payment.

You initiate the refund via your merchant system or API, and Brite handles the instant payout. Our Instant Refunds feature ensures the consumer receives the funds in their bank account in seconds, drastically improving consumer satisfaction and reducing support costs.

My customers are used to cards. Will a Brite Instant Payment hurt our conversion rate?

Brite Instant Payments can positively improve your conversion rate.

According to YouGov and other research sources, consumers are adopting Pay by Bank because it is faster and more secure than traditional credit or debit cards. By eliminating the friction of entering lengthy card numbers, our optimised UX boosts success rates.

Our ‘Pay Faster Next Time’ feature makes the experience even faster for returning consumers.

In which markets are Brite Instant Payments available?

Brite Instant Payments are available in 27 markets across Europe. We are connected to more than 3,800 banks, providing wide coverage and allowing you to centralise payments and treasury with a single integration.

Markets where Brite payments are available:

Belgium

Denmark

Estonia

Finland

France

Germany

Latvia

Lithuania

Netherlands

Sweden

What is Pay Faster Next Time, and how does it help returning consumers?

Pay Faster Next Time is our innovative solution designed to maximise loyalty and repeat sales by significantly speeding up the checkout process.

It’s the Open Banking equivalent of a one-click payment: allowing returning consumers to complete their purchase using only one streamlined authentication step. When combined with our Bank Account Selector, consumers are able to complete the Brite Instant Payment journey in a matter of seconds, using their preferred bank account.