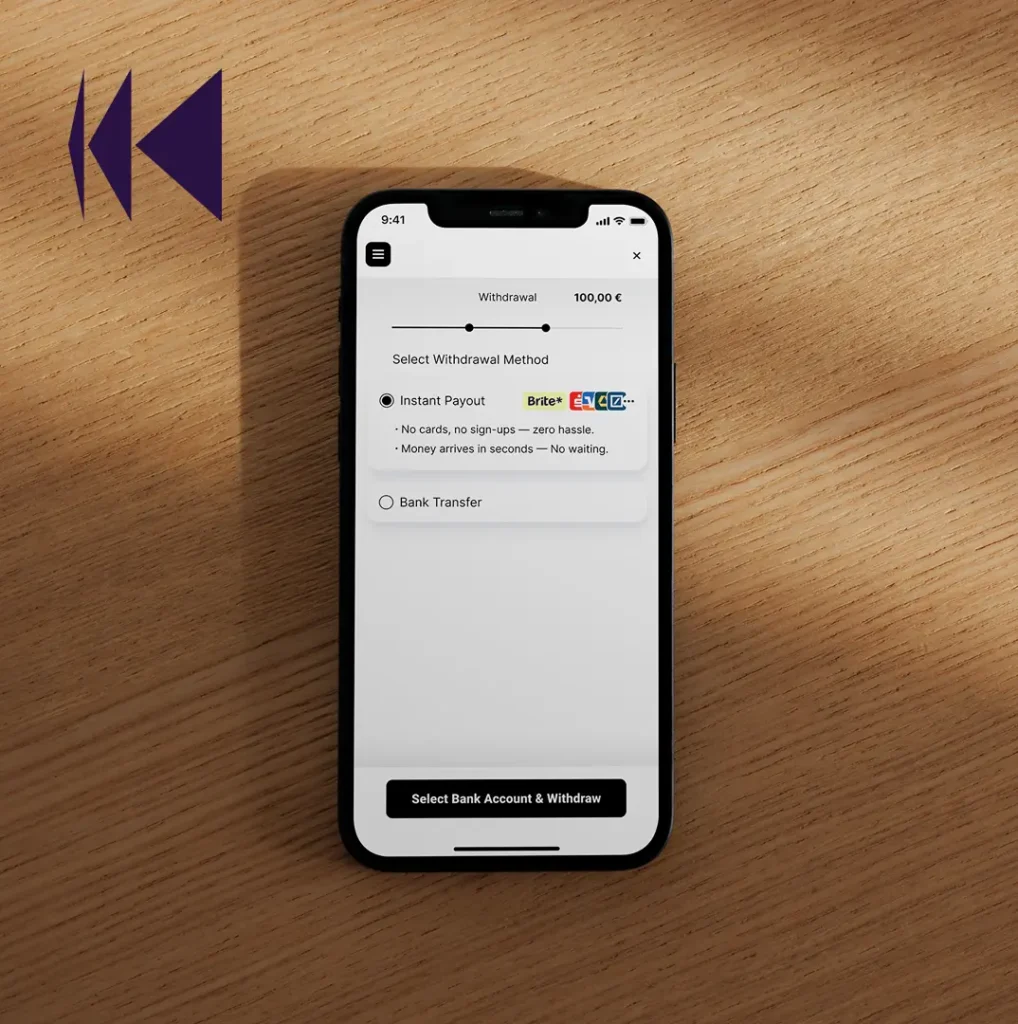

Instant Payouts

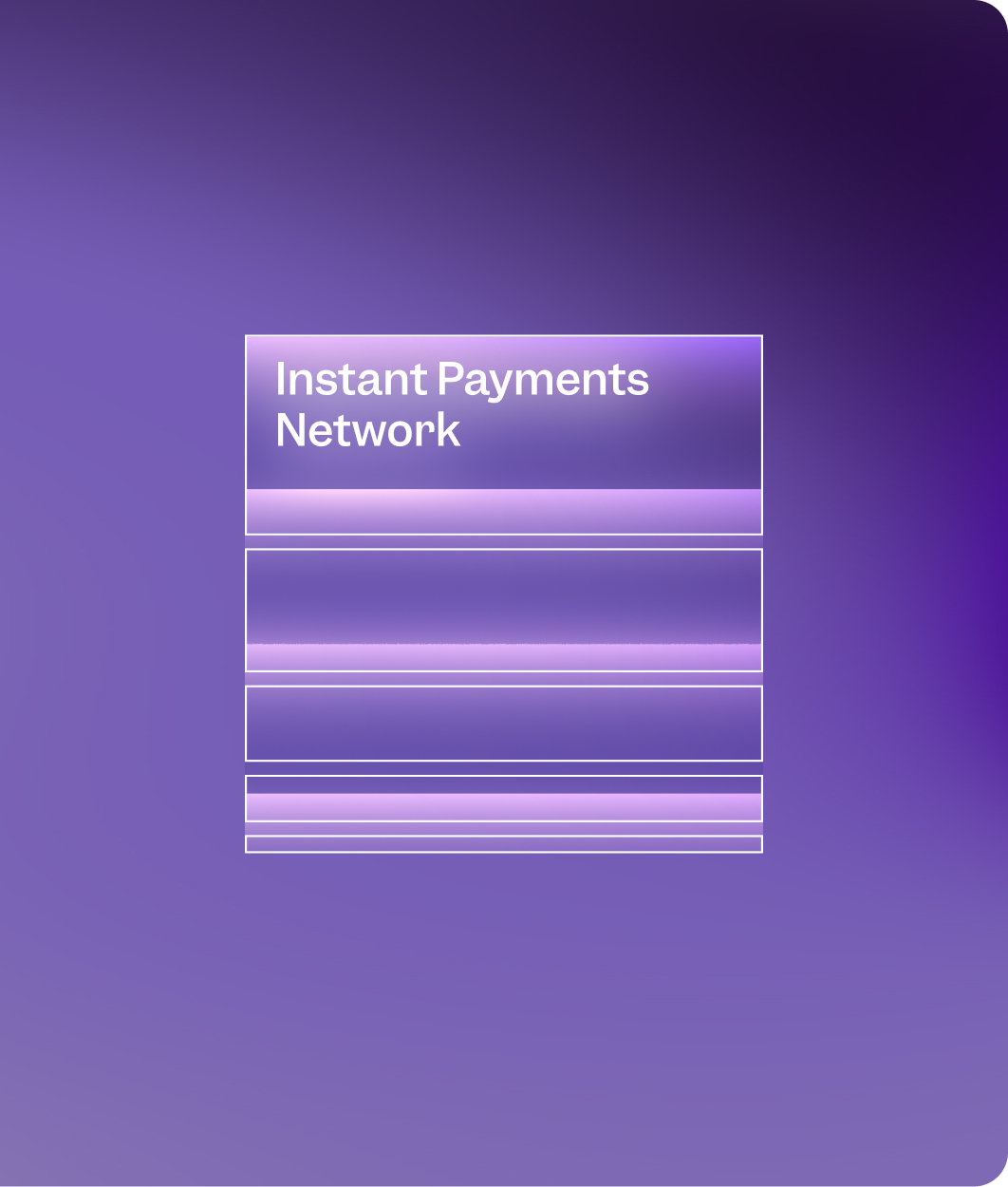

Pay Anyone, Instantly

Slow payouts kill your brand. Delight consumers and cut operational costs with the payout network built for speed.

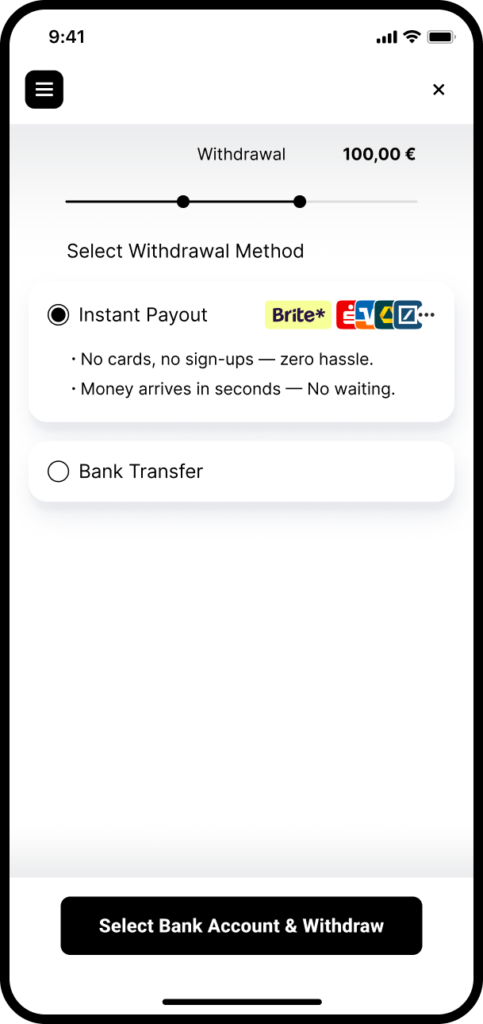

Fast and flexible payouts

Win Consumer Trust

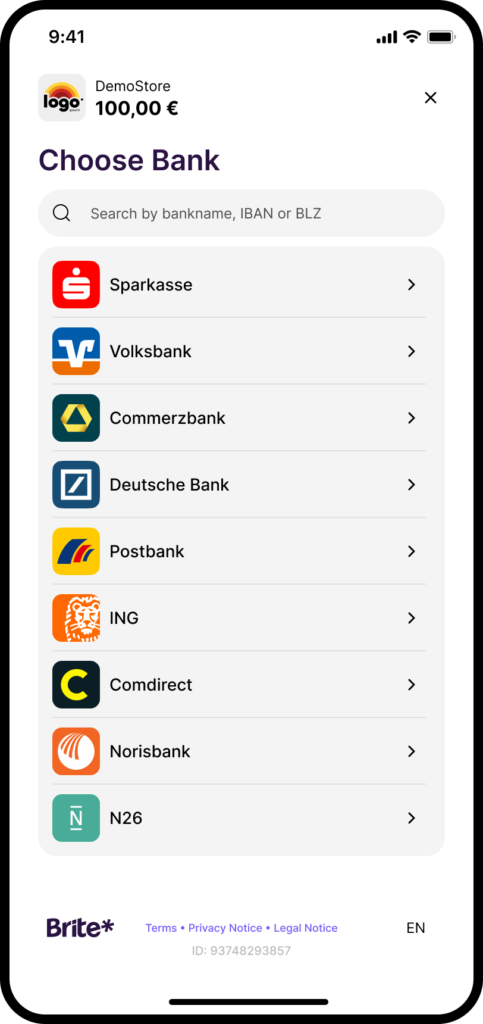

Europe Covered

“Where’s my Money?”

Raise the Limit

Our A2A payouts benefit from bank transaction limits that meet your most valuable consumers’ needs.

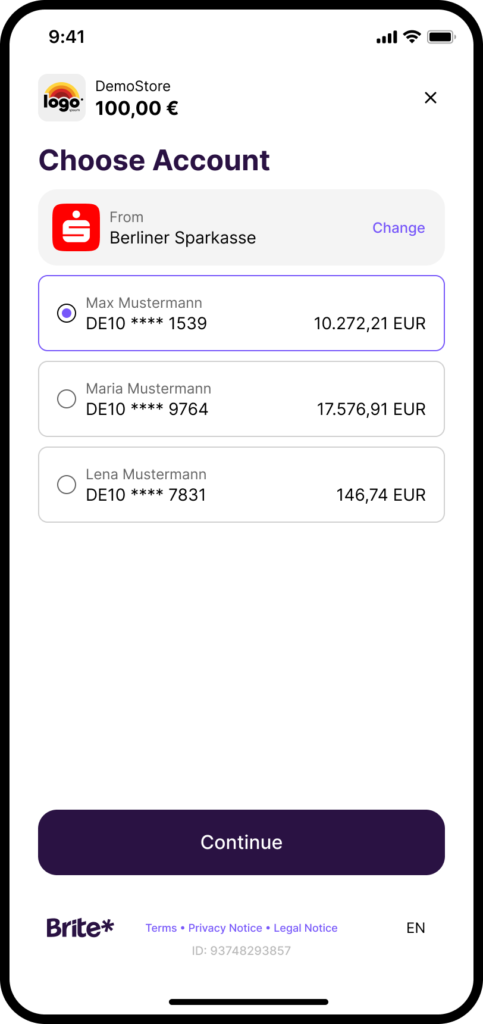

Simple steps for total control

Brite Performance

>99%

<40s

1 click

Key feature

The Engine behind Brite Instant Payouts

Routing payments across Europe within seconds, the Brite Instant Payments Network is built to process instantly 24/7, 365 days a year, minimising dependency on traditional bank clearing cycles and cut-off times.

Payout features that give you the edge

Time2Money

Merchant FX

Live Payout Tracking

Our Customers

Financial Services

Financial Services

Utilities

Built for Scale. Ready in Hours.

Our simple, developer-first API lets you integrate and launch instant payouts, fast. Stop batching, start automating, and scale with ease.

Essential Resources

Your Instant Payout Questions Answered

How fast is an Instant Payout? And when does the consumer actually get their money?

A Brite Instant Payout is typically delivered in seconds.

Our proprietary network operates 24/7, 365 days a year, meaning the consumer receives their money immediately, without being held up by bank holidays or weekend clearing cycles. The payment is processed and cleared at the same speed.

Internal Brite data shows that the median settlement time for a payout to arrive is around 4 seconds.

What happens if a Brite payout fails (e.g., wrong account details)?

Brite’s system includes automated checks and retry mechanisms to resolve common errors instantly. If a payout genuinely fails (e.g. closed account or incorrect details), you receive an immediate status notification via API or dashboard. This allows your customer support team to contact the consumer promptly to correct the details and ensure a speedy resolution.

If you, as a merchant, send funds to the wrong person, you are covered under bank scheme rules to be able to push for the funds to be returned.

Can we send an Instant Payout to a customer who paid us using a different method (like a card)?

Yes. Through our Manual Payouts feature, you can issue refunds or send funds to any consumer’s bank account, even if the original deposit was made using an external method, such as a card.

This gives you maximum flexibility for customer service and operational reconciliation.

How does Brite’s Merchant FX feature work for cross-border payouts?

Merchant FX simplifies your cross-border treasury. It allows you to fund your Brite balance in one single currency, and then exchange that balance directly within our platform to pay consumers in multiple local European currencies at competitive rates.

This eliminates the need for multiple balances and reliance on external bank FX processing.

What is Brite’s Time2Money feature, and how does it help my customer support team?

Time2Money is a powerful feature that provides the estimated time of arrival (ETA) for a consumer’s payout. This helps you proactively communicate accurate timelines, drastically reducing “Where Is My Money?” (WIMMO) support tickets and building overall consumer trust.